Call us at +420 739 262 937 or +1 985 502-5246

Or email us at inquiries@kolarsky.com

Global Energy Strategies

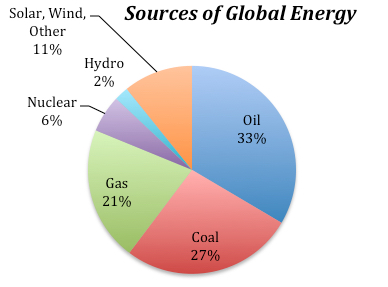

At KDC, we keep a global perspective on the economic and political developments in the world around us. The global economy has been rapidly growing since WWII. The pie chart on the left explains exactly what powers it, The current contributions to our global energy from different sources shows that fossil fuels account for 81% of our energy (data from International Energy Agency and David Bice, Pennsylvania State University).

At KDC, we keep a global perspective on the economic and political developments in the world around us. The global economy has been rapidly growing since WWII. The pie chart on the left explains exactly what powers it, The current contributions to our global energy from different sources shows that fossil fuels account for 81% of our energy (data from International Energy Agency and David Bice, Pennsylvania State University).

Just as much as we embraced globalization in the 1990s and 2000s, we now work on the gradual transition to renewables. In terms of historical parallels, globalization and the green transition represent fundamental shifts and great milestones that can only be compared to the Industrial Revolution.

Just as much as we embraced globalization in the 1990s and 2000s, we now work on the gradual transition to renewables. In terms of historical parallels, globalization and the green transition represent fundamental shifts and great milestones that can only be compared to the Industrial Revolution.

Globalization brings challenges. Today, Asia has the fastest growing middle class, The new global middle class in China, India and Brazil have propelled their respective economies to the same size as those of the G7 countries. The Brookings Institution estimates that there are 1.8 billion in the middle class, which will grow to 3.2 billion by the end of this decade. Asia is almost entirely responsible for this growth. Its middle class is forecast to grow to 3 billion by 2030. It would be 10 times more than North America and five times more than Europe.

Globalization brings challenges. Today, Asia has the fastest growing middle class, The new global middle class in China, India and Brazil have propelled their respective economies to the same size as those of the G7 countries. The Brookings Institution estimates that there are 1.8 billion in the middle class, which will grow to 3.2 billion by the end of this decade. Asia is almost entirely responsible for this growth. Its middle class is forecast to grow to 3 billion by 2030. It would be 10 times more than North America and five times more than Europe.

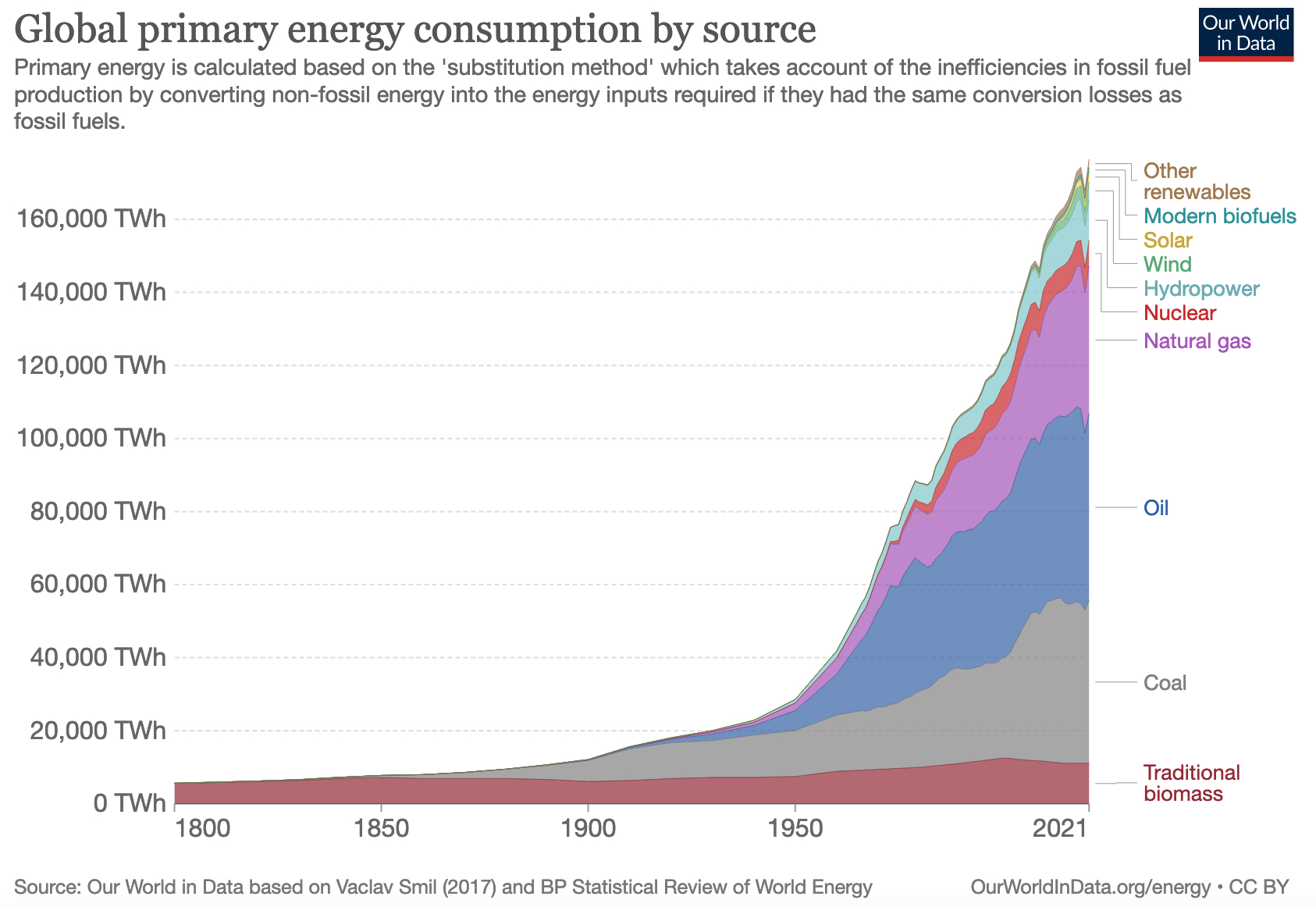

This growth inevitably translates to ever-increasing energy needs. Not only does the rapidly growing global middle class buy automobiles, flies and builds houses, the lion share of the energy consumption increase will come from the infrastructure required to support it: heating, air conditioning, public transportation, shopping centers, airports etc. This infrastructure requires energy: both from fossil fuels and renewables. For the foreseeable future, for traditional and renewable energy sources have to go hand-in-hand to sustain this growth. For the past 70 years, the world has been powered increasingly more and more by oil, gas and coal. Other energy sources including renewables are gaining share, but it will take many decades before they can replace fossil fuels.

This growth inevitably translates to ever-increasing energy needs. Not only does the rapidly growing global middle class buy automobiles, flies and builds houses, the lion share of the energy consumption increase will come from the infrastructure required to support it: heating, air conditioning, public transportation, shopping centers, airports etc. This infrastructure requires energy: both from fossil fuels and renewables. For the foreseeable future, for traditional and renewable energy sources have to go hand-in-hand to sustain this growth. For the past 70 years, the world has been powered increasingly more and more by oil, gas and coal. Other energy sources including renewables are gaining share, but it will take many decades before they can replace fossil fuels.

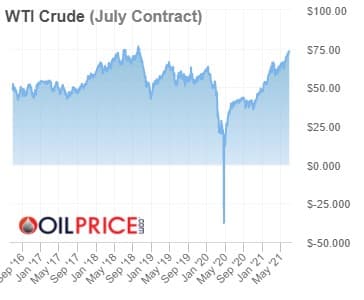

Oil and gas companies are facing one of their most challenging times. For many, a key to adapting will be finding an informed perspective that can help them position themselves for what the future will bring. We understand the challenges that are facing the oil and gas industry: pressure to reduce carbon emissions, volatile commodity prices, rapidly shifting markets, changing demand patterns, financing and regulations.This environment is difficult for organization to assess and manage the changes.

Oil and gas companies are facing one of their most challenging times. For many, a key to adapting will be finding an informed perspective that can help them position themselves for what the future will bring. We understand the challenges that are facing the oil and gas industry: pressure to reduce carbon emissions, volatile commodity prices, rapidly shifting markets, changing demand patterns, financing and regulations.This environment is difficult for organization to assess and manage the changes.

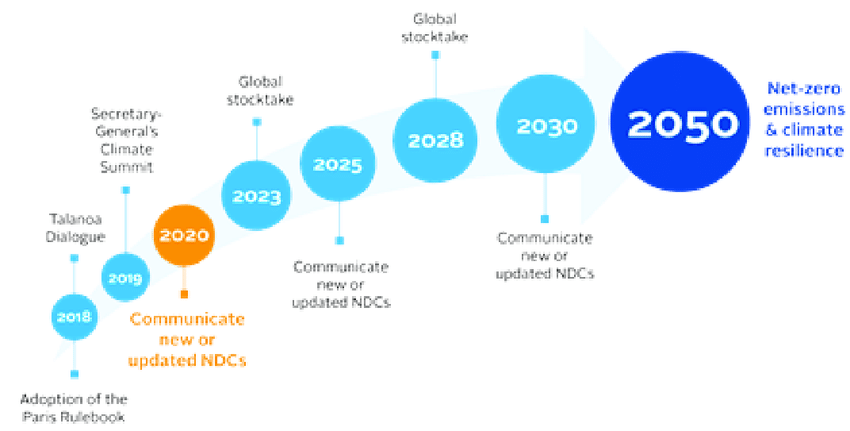

The Paris Agreement had an impact on long-term strategies, the oil price crash of 2015 put a huge financial strain on the oil industry, the slow recovery and the COVID pandemic put an even more strain on the already struggling oil industry, and then came the Russo-Ukrainian War that suddenly shook up the supply side of the market. Europe had to adapt to changing crude oil and mainly natural gas suppliers in just half a year!

Energy suppliers are balancing a competing set of demands from customers, investors, regulators, market operators and employees. Technology and innovation is revolutionizing how the industry can meet their various needs, if organizations can balance the various safety, customer, and return on capital needs to make the investment. Power and utility companies are undergoing a major transformation to keep up with shifting energy needs.

Energy suppliers are balancing a competing set of demands from customers, investors, regulators, market operators and employees. Technology and innovation is revolutionizing how the industry can meet their various needs, if organizations can balance the various safety, customer, and return on capital needs to make the investment. Power and utility companies are undergoing a major transformation to keep up with shifting energy needs.

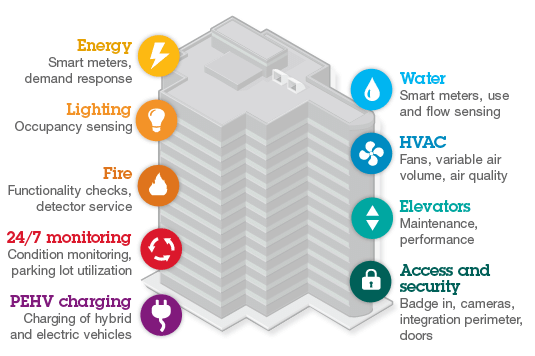

We have experience implementing emerging technologies, including smart sensors and data analytics capabilities that can help drive efficiency and meet customer expectations for service, personalization, and control. As power and utility companies define their major infrastructure needs across generation, transmission and distribution—including the addition of more renewable sources—we can provide insight into capital resources and deal opportunities to make it happen.

We have experience implementing emerging technologies, including smart sensors and data analytics capabilities that can help drive efficiency and meet customer expectations for service, personalization, and control. As power and utility companies define their major infrastructure needs across generation, transmission and distribution—including the addition of more renewable sources—we can provide insight into capital resources and deal opportunities to make it happen.

We also help identify vulnerabilities and risk-management practices for threats such as cyber-attacks and geopolitical events. For example, Europe has long been thought of as regional with a low risk of geopolitical upheaval. For 10 years, KDC has been advising several EU governments and large gas and electricity utility companies to diversify their gas suppliers and not put all their eggs in one basket by depending on Russia. The Russian invasion of Ukraine put to a swift end the apparent geopolitical and energy stability of Europe. KDC professionals can help them stay on top of various policies and trends, customer empowerment, grid modernization, greenhouse gas emissions controls, decentralized energy, and sector convergence.

We also help identify vulnerabilities and risk-management practices for threats such as cyber-attacks and geopolitical events. For example, Europe has long been thought of as regional with a low risk of geopolitical upheaval. For 10 years, KDC has been advising several EU governments and large gas and electricity utility companies to diversify their gas suppliers and not put all their eggs in one basket by depending on Russia. The Russian invasion of Ukraine put to a swift end the apparent geopolitical and energy stability of Europe. KDC professionals can help them stay on top of various policies and trends, customer empowerment, grid modernization, greenhouse gas emissions controls, decentralized energy, and sector convergence.

As the industry struggles through this transition, we help organizations understand how to better compete for needed talent against other industries, as well as to upskill an aging workforce for new demands.

As the industry struggles through this transition, we help organizations understand how to better compete for needed talent against other industries, as well as to upskill an aging workforce for new demands.

The "fracking revolution" has tranformed the oil and gas production environment in a fundamental way. It made the United States the No. 1 producer of crude oil and natural gas in the world, becoming a net exporter of both, rather than depending on unstable countries like Saudi Arabia, Nigeria or Russia. The U.S. is now a major LNG-exporter, which came just in time for Europe, which faces the possibility of not being able to import Russian gas (either due to an embargo, or to Moscow shutting off the tap). When Russia started the war, the market reaction was immediate - and shocking to consumers -oil rose to above $100 again, and European gas prices quadrupled! This came at a time when the energy industry was just overcoming 2 years of postponed projects, problems with the sputtering global logistical supply chain, and a sudden lack of people. THe challenge for Europe is enormous: overcome decades of misguided political decisions that have led to Europe's dependency on Russian oil and gas. Thankfully, the global LNG business is coming to a rescue: LNG imports from the U.S. and Quatar to import terminals on Europe's west coast are replacing Russian gas. Europe is now running on 4 major sources of natural gas: Norwegian and Algerian gas via pipelines, and LNG from Qatar and the U.S. via tankers.

The "fracking revolution" has tranformed the oil and gas production environment in a fundamental way. It made the United States the No. 1 producer of crude oil and natural gas in the world, becoming a net exporter of both, rather than depending on unstable countries like Saudi Arabia, Nigeria or Russia. The U.S. is now a major LNG-exporter, which came just in time for Europe, which faces the possibility of not being able to import Russian gas (either due to an embargo, or to Moscow shutting off the tap). When Russia started the war, the market reaction was immediate - and shocking to consumers -oil rose to above $100 again, and European gas prices quadrupled! This came at a time when the energy industry was just overcoming 2 years of postponed projects, problems with the sputtering global logistical supply chain, and a sudden lack of people. THe challenge for Europe is enormous: overcome decades of misguided political decisions that have led to Europe's dependency on Russian oil and gas. Thankfully, the global LNG business is coming to a rescue: LNG imports from the U.S. and Quatar to import terminals on Europe's west coast are replacing Russian gas. Europe is now running on 4 major sources of natural gas: Norwegian and Algerian gas via pipelines, and LNG from Qatar and the U.S. via tankers.

The European dependency on Russian gas, which has been in the making for the past 30 years, and the Russo-Ukrainian War proved in a clear and brutal way the central thought of Daniel Yergin's "The Prize": 'He who controls the supplies of crude oil and natural gas has power and influence in the world'

A re-thinking the timing of the Paris-Agreement commitments will be the inevitable result of the recent geopolitical events. Nuclear power plants will have to stay in operation much longer; coal, oil and gas will remain at the core of energy consumption for decades longer.

In a fast-changing industry, energy companies clearly need to adopt new operating models, enter new markets and businesses, and capture new growth opportunities. We help companies to design and implement large-scale change programs that will increase their flexibility, transform their performance, and revitalize their organizations.

In a fast-changing industry, energy companies clearly need to adopt new operating models, enter new markets and businesses, and capture new growth opportunities. We help companies to design and implement large-scale change programs that will increase their flexibility, transform their performance, and revitalize their organizations.

We work closely with each company to develop a fit-for-purpose transformation program that meets their unique needs and leaves them better equipped to tackle future challenges and uncertainties. We help companies to find better ways of working that are rooted in practical experience as well as innovative thinking.

Given the current geopolitical situation, we help companies capture maximum value from the sourcing, trading, transportation, distribution, and storage of natural gas and LNG. The natural gas industry faces complex challenges, from assessing the robustness of unconventional gas production in North America, to evaluating the impact of LNG pricing and demand in Asia, and specifically in the wake of the Russo-Ukrainian War being cut off from, or having to give up, Russian gas supplies. To navigate an unpredictable market, companies need a global perspective on the dynamics of the business, analytical rigor in weighing strategic options, and the flexibility to respond swiftly to shifts in supply, demand, regulatory context, and competitive behavior.

Given the current geopolitical situation, we help companies capture maximum value from the sourcing, trading, transportation, distribution, and storage of natural gas and LNG. The natural gas industry faces complex challenges, from assessing the robustness of unconventional gas production in North America, to evaluating the impact of LNG pricing and demand in Asia, and specifically in the wake of the Russo-Ukrainian War being cut off from, or having to give up, Russian gas supplies. To navigate an unpredictable market, companies need a global perspective on the dynamics of the business, analytical rigor in weighing strategic options, and the flexibility to respond swiftly to shifts in supply, demand, regulatory context, and competitive behavior.

KDC can assisst your organization in many ways.Get in touch with us today!